Administration of Rules of Origin under Trade Agreements (CAROTAR,2020)

VIEWS By SCMCube August 20, 2022

In terms of section 28DA of the Customs Act, 1962, an importer making a claim for preferential rate of duty is required to possess sufficient information as regards the manner in which country of origin criteria, including the regional value content and product specific criteria, specified in the rules of origin in the trade agreement, are satisfied.

For the above purpose, this Form contains a list of basic minimum information which an importer is required to possess while importing the goods. Section 28DA of the Act further requires that the importer shall exercise reasonable care to accuracy and truthfulness of the information supplied and the preferential claim. Hence, any additional information, as deemed fit to ascertain correctness of the country of origin criterion, may also be obtained.

Wherever necessary, technical terms used in the Form have been explained as below for general guidance. Each trade agreement, however, has its own set of Rules of Origin, and precise definition of each of the term listed below may vary. Importers are, therefore, advised to refer to the respective Rules of Origin also, as notified in terms of sub-section (1) of section 5 of the Customs Tariff Act, 1975.

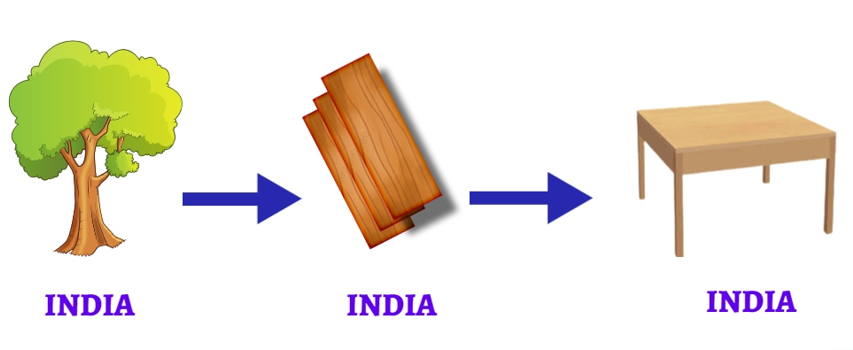

What is the Wholly Obtained Standard?

Wholly obtained standard is the rule to determine whether the goods are wholly obtained or produced in a country or region. “Regulations on Place of Origin” states that the standard of entirely obtained is as follows: “Where all the goods are sourced from one country or region, the country or region shall be the place of origin of the goods.” With regard to “all the goods are sourced from one country or region”, both rules on preferential and non-preferential origin are specified by way of classification.

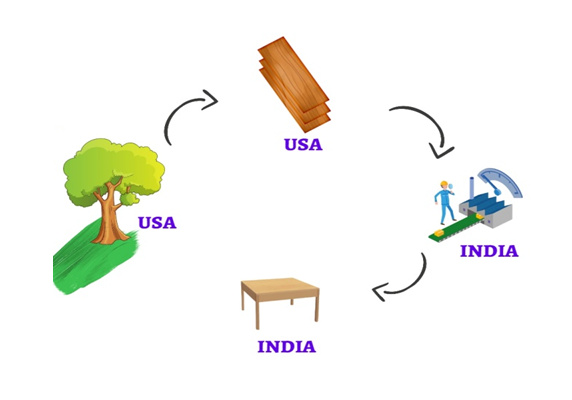

What is the Non-Wholly Obtained Standard?

Goods that are produced using non-originating materials i.e. not Wholly Obtained, are required to undergo substantial transformation in a country for the good to be qualified as originating. This criterion can be met using following method in combination or standalone, depending upon the criteria assigned for a goods

- (a) Change in Tariff Classification (CTC);

- (b) Regional or Domestic Value Content (RVC/DVC); and

- (c) Process rule.